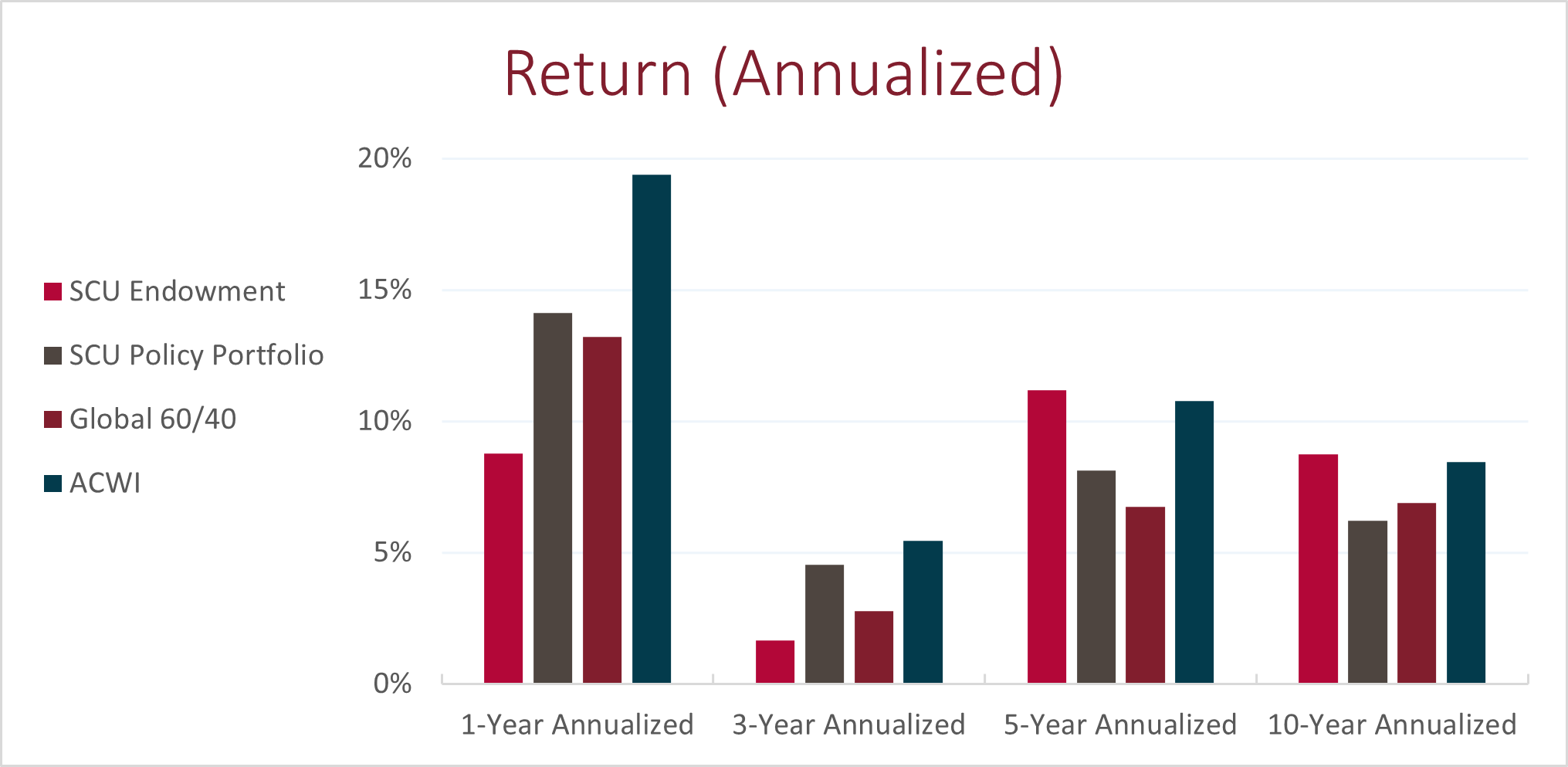

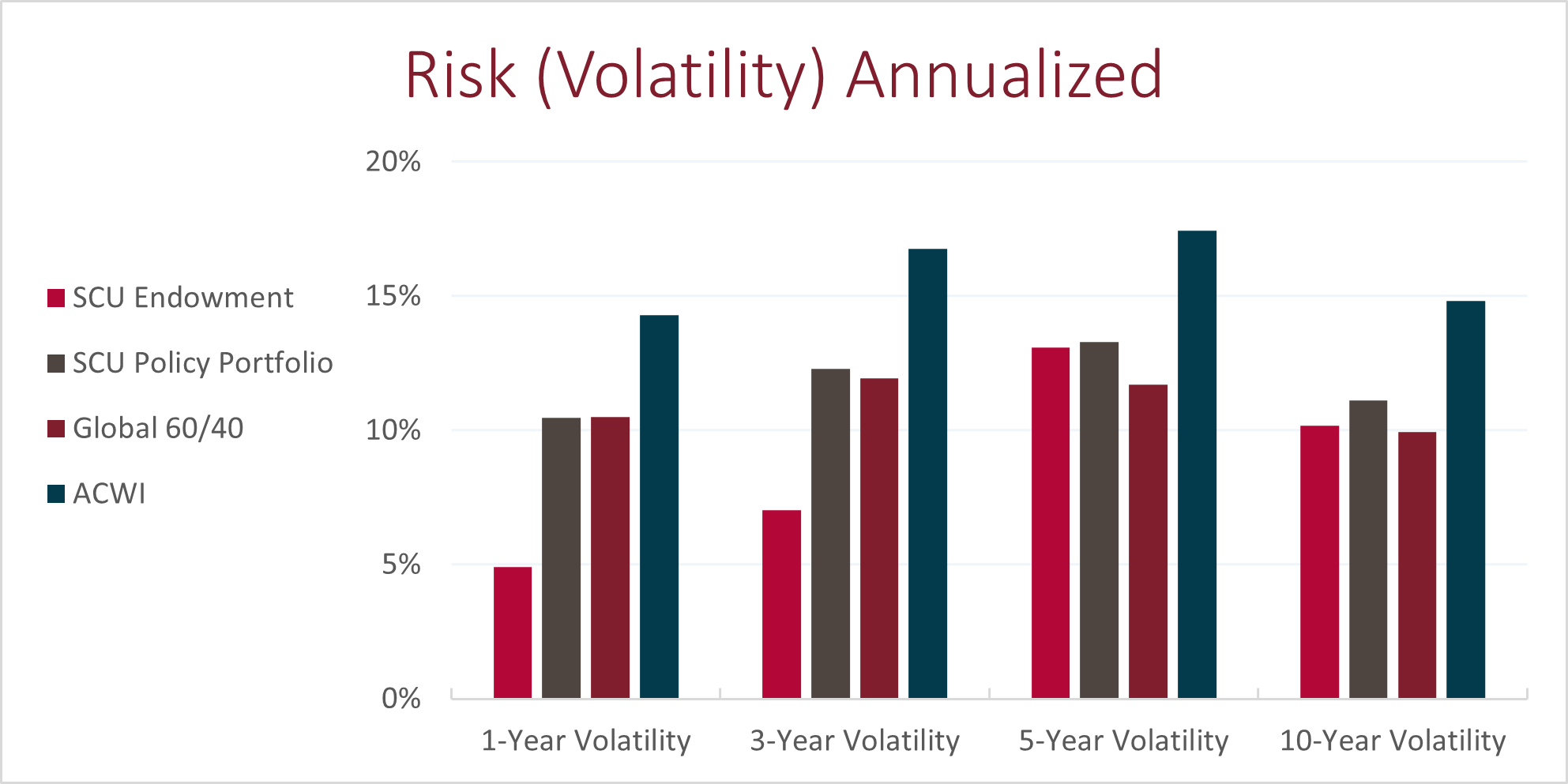

As stewards of the University’s endowment, the Santa Clara Investment Office manages a diversified investment portfolio that provides recurring financial support for key university operations. The goal is to generate sufficient investment returns so that the portfolio can serve both the needs of current and future generations of university stakeholders. We refer to this as “intergenerational equity.”

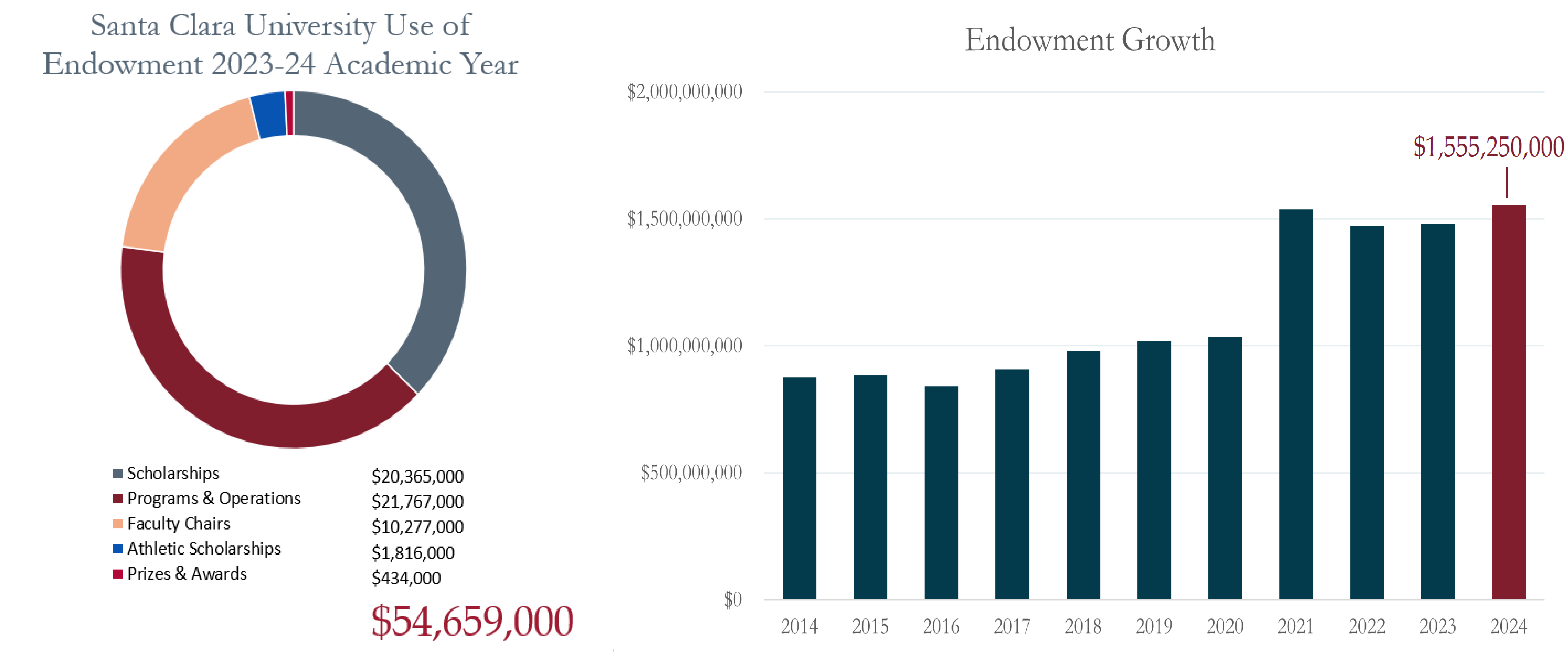

Underlying the endowment are over 1,000 donor designated pools, each contributing in a unique way to help Santa Clara deliver a world-class Jesuit education. The largest designations include merit and need-based scholarships, funding for a variety of university programs and endowed chairs to attract prominent faculty. Every year, the university liquidates approximately 4.5% of the portfolio and contributes the proceeds to fund current operations. In fiscal 2024, this has equated to $55 million or 9% of the university’s operating budget.